Building Partnerships

COCC’s partnership model is the primary reason why more community banks and credit unions put their trust in us and the products and services we deliver. Our clients know that they will have an all-encompassing team to support their community. We strive to listen to our clients and their customers so that we can continue providing the best service, technology, and relationships — delivering a true partnership.

What our clients are saying.

One of the biggest things that we noticed in dealing with COCC in terms of communication, was the open dialogue, willingness to listen, ask questions, and put forward ideas that align with our vision. This process highlighted COCC’s culture and how they approach a partnership.

– Main Street Bank

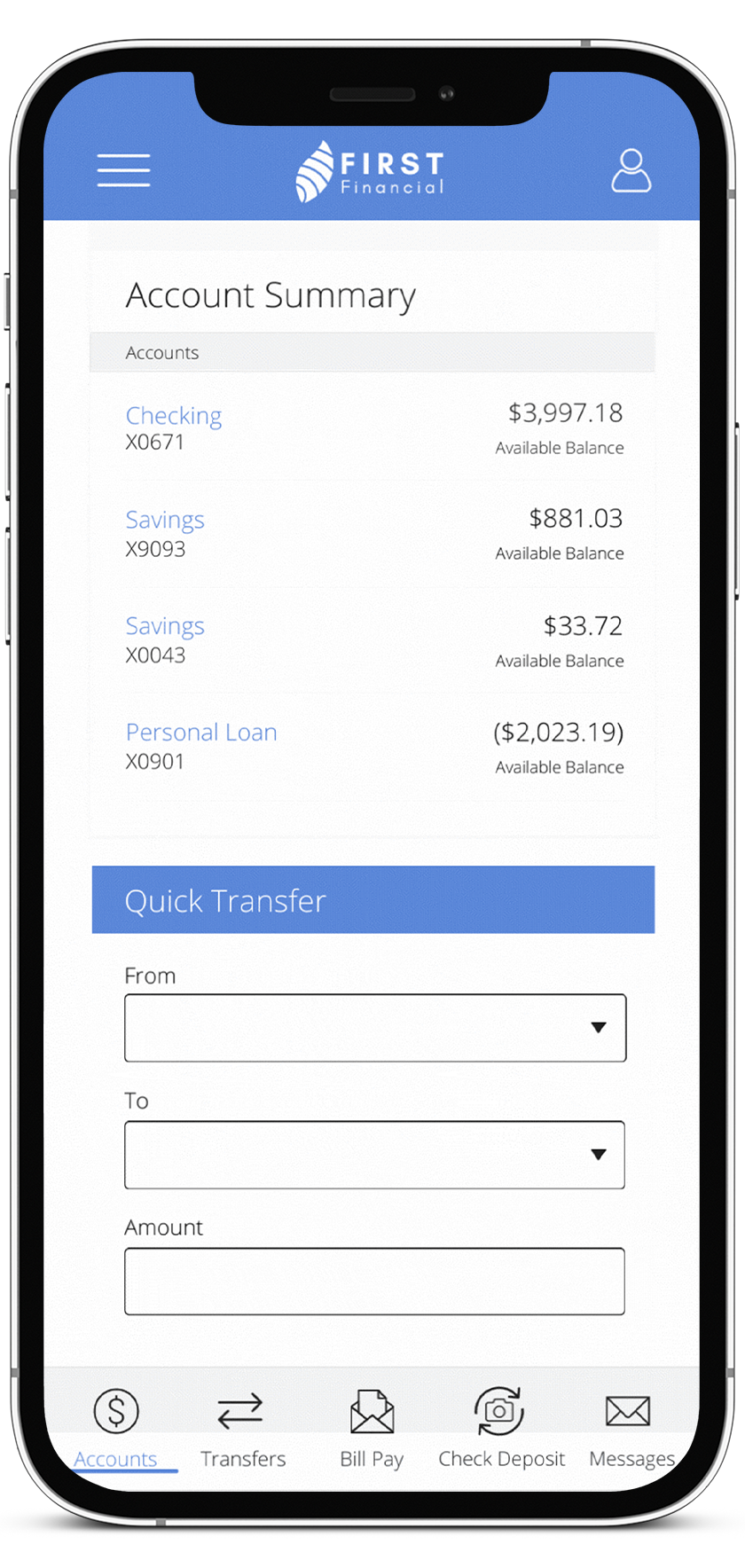

UX Reimagined

COCC’s Digital Banking solution is your virtual branch, empowering community institutions to deliver a consistent financial experience across all digital channels, resulting in high levels of customer adoption, engagement and satisfaction.

Protecting Our Clients

Well equipped to deliver managed security services and solutions to fortify existing security policies or implement a new one. Learn more about our Cybersecurity & Risk Management offerings.

The Latest from COCC

MCS Bank Chooses COCC to Power a Unified, Future-Ready Core Bank Strategy

COCC is proud to announce that MCS Bank has selected COCC as its new core banking and digital platform provider.

BankNewport’s Mobile Experience Earns World-Class Customer Satisfaction

BankNewport, a $3B financial institution headquartered in Middletown, Rhode Island, has steadily elevated its mobile banking experience to meet the expectations of digital-first customers.

COCC’s Richard Leone Named a Top 3 Financial Technology CEO of 2025 by The Financial Technology Report

Placing at #3, the prestigious annual list recognized visionary leaders from organizations with national and international reach who are shaping the future of the fintech industry.

Join Our

Collaborative Movement

Find out what makes us one of the best places to work in Connecticut year after year.